Why is Red Rock Resorts’ Share Price Underperforming the Market and Its Peers?

Why is Red Rock Resorts’ Share Price Underperforming the Market and Its Peers?

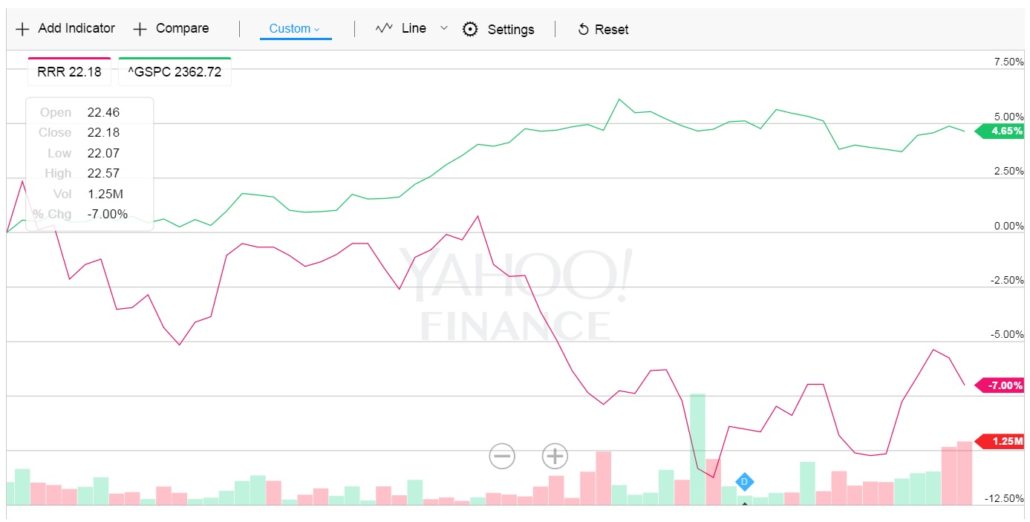

In the first quarter of 2017, Red Rock Resorts’ Class A share price declined by 7% while the S&P 500 index went up by 4.65%.

(Source: Yahoo Finance)

RRR’s share price dropped while other regional gaming operators’ share prices rose in the quarter:

(Source: Yahoo Finance)

What explains this significant underperformance of RRR stock? We believe investors are likely concerned with the Palms acquisition and the uncertainty in the company’s growth pipeline:

Is the Palms acquisition meeting management expectation?

When the $316-million Palms acquisition was first announced last May, the company said that “[f]actoring in anticipated synergies, the Company estimates that the Palms will generate $35 million in EBITDA during the Company’s first full year of ownership.” Is the company on track to meet this goal?

When Station Casinos officially took ownership of the Palms on Oct. 1, Michael Jerlecki, who had been the general manager of Palace Station, became the resort’s GM. However, Jerlecki was replaced by Anthony Faranca by early February without any public announcement from the company. (The new GM is mentioned in passing in a local columnist’s write-up on new assistant manager Jon Gray.) We do know from the company’s recently filed 10-K that Palms had a net pretax loss of $1.3 million in the fourth quarter on net revenues of $38.5 million.

Given these numbers, investors might wonder whether the Palms is on track to make $35 million in EBITDA through September 30 this year. While the company did not provide property-level breakout of Palms’ EBITDA for the fourth quarter, investors should demand greater clarity going forward so they can better understand whether the expensive, debt-financed purchase is paying off as management had anticipated.

What happened to the Palms Place hotel rooms?

The company’s 10-K shows there were 713 hotel rooms at the Palms, but makes no mention of the condo-hotel units at Palms Place. Back in September, the company’s investor presentation showed that, at Palms, in addition to 713 rooms across two hotel towers, there were “approximately 448” condo units at the stand-alone Palms Place tower in the “room rental program, pursuant to which the Company receives 50% of the room rate and 100% of the resort fee on any such rentals.”

What happened to these 448 hotel units at Palms Place? They would account for about 39% of total available hotel units at the company’s new acquisition. The 10-K does not say anything about this Palms Place condo-hotel program. Has the company decided not to manage Palms Place’s hotel pool anymore? If so, how might that affect the goal of making $35 million in EBITDA at the Palms through September 30?

Why is no one adding significant capacity in the Las Vegas locals market?

We recently took a closer look at the company’s new development pipeline in Las Vegas and found little that was “shovel ready.” Given the lack of discussion on this issue during the analyst call, we believe some further questions are warranted.

For example, when will the company tell investors more about the planned second hotel tower at Palace Station, which received planning approval in September? The planned tower is absent from the discussion of the on-going $115-million “upgrade” of Palace Station in the company’s latest investor presentation from March 20.

While the company continues to tout its “Existing Development Sites” in Las Vegas such as “Durango” and “Viva” in its March presentation, it has not announced any concrete plans to build out those sites. Moreover, there are ten “Gaming Enterprise Districts” in the Las Vegas Valley which are not owned or controlled by Station Casinos.

(See our interactive map of casinos and casino sites in the Las Vegas locals market.)

The existence of these non-Station future casino sites should make investors skeptical of any claims of barriers of entry to the Las Vegas locals market. Moreover, if the Las Vegas locals market is growing significantly, why have these other developers not seen fit to build out new Las Vegas locals casinos?

What will happen in the company’s tribal casino management segment in 2021?

Outside of Las Vegas, there are looming challenges in the company’s tribal casino segment. Its two existing management agreements expire in February, 2018, and November, 2020, respectively. The company estimates that its only other tribal casino project will require another 36 to 48 months to begin construction and 18 months after construction begins to complete and open.

This means the earliest opening date would fall around September, 2021, and that the company most likely will not have a tribal casino management fee revenue stream in 2021. To be clear, the tribal casino management segment accounted for 7.6% of the company’s net revenues and 18.0% of adjusted EBITDA in 2016.

It should be noted that the company’s $225-million Term Loan A and $685-million Term Loan B both mature in June 2021, and its $500 million of 7.5% senior notes are due March 1, 2021. That is a total of approximately $1.4 billion of debt coming due when the company will likely not have any tribal casino management revenue. Will the company be able to roll over that debt given this potential lack of tribal casino management revenue in 2021?