Cohen & Steers, Inc. (NYSE: CNS) filed a Schedule 13G on December 12, 2016, announcing its beneficial ownership (at the time 15.94% of Class A shares) in Red Rock Resorts. This was an interesting move by Cohen & Steers, which is often praised as the “king of REITs”[i],[ii] and self-described as “pioneers in REIT investing.”[iii] The company has no other investments in the gaming industry besides the REIT Gaming and Leisure Properties.[iv] However, since Red Rock is not a REIT and has not announced any plans to convert its assets into a REIT, why did CNS take such a large stake in Red Rock and continue to hold on to it? Red Rock’s stock (the publicly-traded Class A shares) has struggled year-to-date compared to the market and its regional gaming peers. CNS investors should ask how long the firm is willing to wait for its bet on Red Rock to pay off.

Red Rock’s share price has underperformed the markets year-to-date. As of the closing prices on September 29, 2017, the NASDAQ composite index is up 19.7%, the S&P 500 is up 11.9%, and the Russell 2000 is up 9.8%, while Red Rock’s share price has declined by 0.86%. On the other hand, Red Rock’s peers have significantly outperformed the markets year-to-date (Table 1).

Table 1: Share Price % Change YTD (through 9/29/17)

| Company or Index |

Share price (1/3/17, open)

|

Share price (9/29/2017, close) |

Year-to-date % change

|

| Red Rock Resorts |

$23.36

|

$23.16 |

-0.86%

|

| Eldorado Resorts |

$17.10

|

$25.65 |

50.0%

|

| Boyd Gaming |

$20.40

|

$26.05 |

27.7%

|

| Golden Entertainment |

$12.24

|

$24.38 |

99.2%

|

| Pinnacle Entertainment |

$14.65

|

$21.31 |

45.5%

|

| Penn National |

$13.90

|

$23.39 |

68.3%

|

| Gaming and Leisure Prop (REIT) |

$30.77

|

$36.89 |

19.9%

|

| MGM Growth Properties (REIT) |

$25.31

|

$30.21 |

19.4%

|

| NASDAQ composite index |

$5,425.62

|

$6,495.96 |

19.7%

|

| Dow Jones Industrial Average |

$19,872.86

|

$22,405.03 |

12.7%

|

| S&P 500 |

$2,251.57

|

$2,519.36 |

11.9%

|

| Russell 2000 |

$1,357.99

|

$1490.86 |

9.78%

|

|

Source: Yahoo Finance

|

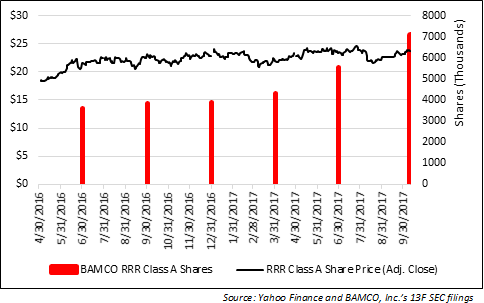

Cohen & Steers’ 13G filed on December 12, 2016, shows the company owned 9,739,009 of Red Rock’s Class A shares. At the start of 2017, the value of these shares was approximately $228 million.[v] Red Rock’s share price has not appreciated year-to-date (through 3Q17). If Cohen & Steers had put this $228 million investment in nearly any other gaming company, including the two actual gaming REITs, it would have generated sizable returns for its investors and clients (Table 2). Holding onto Red Rock’s Class A shares had a significant opportunity cost for Cohen & Steers.

Table 2: Market Appreciation and Opportunity Cost YTD (through 9/29/17)

| Company |

Share Price

YTD % change (9/29/17)

|

Potential Value

(9/29/17) |

Opportunity Costs

|

| Eldorado Resorts |

50.0%

|

$342 mm |

$116 mm

|

| Boyd Gaming |

27.7%

|

$291 mm |

$65 mm

|

| Golden Entertainment |

99.2%

|

$454 mm |

$228 mm

|

| Pinnacle Entertainment |

45.5%

|

$332 mm |

$106 mm

|

| Penn National |

68.3%

|

$384 mm |

$158 mm

|

| Gaming and Leisure Prop (REIT) |

19.9%

|

$273 mm |

$47 mm

|

| MGM Growth Properties (REIT) |

19.4%

|

$272 mm |

$46 mm

|

Red Rock’s investment risks are very clear, such as its limited geography diversity, dependence on Las Vegas macro fundamentals, and its long-held but vacant land holdings with few shovel-ready development plans. In its S-1 filed on October 26, 2016, Red Rock states:

We depend on the Las Vegas locals and repeat visitor markets as our key markets, which subjects us to greater risks than a gaming company with more diverse operations.

Except for fees from its set-to-expire management contracts at Gun Lake and Graton ($111 million in 2016)[vi], Red Rock relies on the Las Vegas valley for all of its revenues. In 2016, 92% of the company’s consolidated net revenues were from its Las Vegas operations.[vii] This should be a red flag for investors skeptical about the Las Vegas locals market recovery. (A notable economist and gaming analyst recently cast doubt on the strong growth narrative surrounding the Las Vegas economy.[viii],[ix]) By comparison, Red Rock’s peers are much more geographically diverse (Table 3).

Table 3: Geographic Diversification of Gaming Companies

| Company |

U.S. States with Operations

|

| Red Rock Resorts |

1

|

| Eldorado Resorts |

10

|

| Boyd Gaming |

7

|

| Golden Gaming |

3

|

| Pinnacle Entertainment |

9

|

| Penn National |

16

|

|

*Management contracts excluded

|

Source: SEC filings and company websites

|

Red Rock is also the only company among its peers to have a dual-class capital structure – providing 10-to-1 super voting stock to the Fertitta insiders – as well as numerous other anti-shareholder provisions that have been the subject of governance alerts by Institutional Shareholder Services and the Council of Institutional Investors. Given the abundance of better performing securities in the gaming space, why did Cohen & Steers bet on Red Rock?

The decision by Cohen & Steers fund managers to invest in Red Rock comes at a time when active managers are facing increased pressure to both outperform their passive counterparts and reduce fees. Nearly $500 billion shifted from active to passive funds in the first half of 2017 and Morgan Stanley estimates that global asset managers’ revenue could drop as much as 30% by 2019.[x],[xi] According to S&P Dow Jones Indices’ SPIVA® scorecard, actively-managed large-cap, mid-cap, and small-cap funds have underperformed their respective indices over the 1-, 3-, 5-, 10- and 15-year periods (Table 4).[xii]

Table 4: Percentage of U.S. Equity Funds Outperformed by Benchmarks

| Fund Category |

Comparison Index |

1-year

|

3-year |

5-year |

10-year |

15-year

|

| All Large-Cap Funds |

S&P 500 |

66.00

|

93.39 |

88.30 |

84.60 |

92.15

|

| All Mid-Cap Funds |

S&P MidCap 400 |

89.37

|

94.21 |

89.95 |

96.03 |

95.40

|

| All Small-Cap Funds |

S&P SmallCap 600 |

85.54

|

95.69 |

96.57 |

95.64 |

93.21

|

|

Source: S&P DJI, SPIVA U.S. Year-End 2016 report

|

Notes

[i] Larry Swedroe, “Cohen & Steers: The King Of REITs Poised To Provide Investors 42% Annualized Returns,” Seeking Alpha, May 15, 2014, https://seekingalpha.com/article/2218583-cohen-and-steers-the-king-of-reits-poised-to-provide-investors-42-percent-annualized-returns

[ii] Arturo Neto, “Cohen & Steers: King Of REITs Moving In The Right Direction But It Will Take Patience For The Big Payoff,” Seeking Alpha, September 16, 2014. https://seekingalpha.com/article/2497685-cohen-and-steers-king-of-reits-moving-in-the-right-direction-but-it-will-take-patience-for-the-big-payoff

[iii] Cohen & Steers, Inc., “About Us,” website, accessed on October 5, 2017. https://www.cohenandsteers.com/company

[iv] Cohen & Steers, Inc., SEC Form 13F, Information Table, filed on August 14, 2017. https://www.sec.gov/Archives/edgar/data/1284812/000114036117031503/xslForm13F_X01/form13fInfoTable.xml

[v] Cohen & Steers, Inc., SEC Form SC 13G, filed on December 12, 2016.

[vi] Red Rock Resorts, Inc., SEC Form 10-K, filed on March 13, 2017, p. 21.

[vii] Red Rock Resorts, Inc., SEC Form 10-K, filed on March 13, 2017, p. 48.

[viii] Wade Tyler Millward, “Southern Nevada economy still growing, UNLV economist says,” Las Vegas Review-Journal, June 13, 2017, https://www.reviewjournal.com/business/southern-nevada-economy-still-growing-unlv-economist-says/

[ix] Howard Jay Klein, “Boyd Gaming: Has It Expanded Its Locals Market Base At The Expense Of Bigger Possibilities,” Seeking Alpha, September 18, 2017, https://seekingalpha.com/article/4108010-boyd-gaming-expanded-locals-market-base-expense-bigger-possibilities

[x] Charles Stein, “Active vs. Passive Investing,” Bloomberg, July 6, 2017, https://www.bloomberg.com/quicktake/active-vs-passive-investing

[xi] Sarah Jones, “Asset Manager Revenue May Fall 30% by 2019, Morgan Stanley Says,” Bloomberg, March 17, 2017, https://www.bloomberg.com/news/articles/2017-03-17/asset-manager-revenues-could-slump-30-percent-by-2019-ms-says

[xii] S&P DJI, “SPIVA U.S. Year-End 2016,” report, April 12, 2017, p. 8, http://us.spindices.com/search/?ContentType=SPIVA