Amidst chaos at Palms, Fertittas’ UBS margin loan collateral fell 38%

The now-closed KAOS day/nightclub at Palms was canceling shows the same month shares in Palms’ parent company Red Rock Resorts hit their lowest since the company’s IPO. When in that same month Red Rock controlling owners Frank and Lorenzo Fertitta borrowed $64 million from a related party to fund the purchase of 3.4 million Class A shares in the company (see here, here and here), some claimed the purchases were a show of confidence in the company.

But that is not all that happened in August.

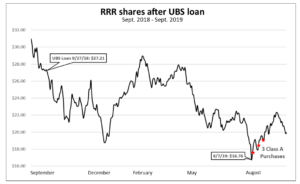

Almost a year prior to these transactions, Frank and Lorenzo Fertitta pledged 6 million Class B shares in Red Rock to secure a margin loan from UBS AG in September 2018 (see UCC here). We estimate the loan was up to $155 million, assuming the ability to borrow 95% of the pledged share value and that the Class B shares were valued the same as Class A shares.

At the time of loan’s filing on September 27, 2018, RRR’s Class A shares traded at about $27.21. When the company’s stock price dropped to $16.76 per share on August 7 this year, the value of the Fertittas’ Class B share collateral for the margin loan would have lost over 38% of its value.

While RRR has not disclosed why the Fertittas needed the UBS margin loan in the fall last year, UBS promotes its securities-backed loans as useful for purchasing yachts, among other things.

Since the UBS loan to the Fertittas, two of the three new Fertitta yachts have launched. Lorenzo Fertitta’s 285-foot Lonian (estimated cost of $160 million) was ready to launch one month prior to the UBS loan, the 216-foot “crazy custom catamaran” Hodor launched in February, 2019, and the 308-foot Viva (Feadship project 817) is scheduled to launch for 2020.