Three Reasons to Eliminate Red Rock’s Dual-class Voting Structure

Lagging Performance

Since Red Rock Resorts went public 5 years ago, its Class A share price has underperformed its peers and the market.

As of 5/26/21, RRR’s Class A shares have gained 116.61% over a 5-year period. Over the same timeframe, the share prices of other regional gaming operators Golden Entertainment, Inc. (GDEN), Boyd Gaming Corp. (BYD), Monarch Casino & Resort, Inc. (MCRI), and Penn National Gaming, Inc. (PENN) share prices went up 231.16%, 243.55%, 241.32%, and 463.43%, respectively. The NASDAQ also went up 180.27.91% over the same period.

Doing away with the dual-class share structure would be a good first step toward maximizing the value of Class A shares of Red Rock Resorts. In the words of a recent Wall Street analyst report: “RRR’s dual-class share structure is suboptimal for most investors and has historically been an impediment to valuation optimization.” (1)

An Entrenched Board

Two years ago, CalPERS raised the issue of board diversity with Red Rock. See Red Rock’s All-White, All-Male Board Draws Calpers’ Attention (Bloomberg, June 2019). At the time, Red Rock said “because the casino business requires an extensive licensing process for board members,” it is “difficult to find qualified candidates.”

Two years later, Red Rock continues to nominate the same five white men to its board and again blames the gaming licensing process for making it difficult to find diverse candidates in this year’s proxy. The company, however, fails to mention that other public-traded Nevada gaming companies have all somehow managed to seat women on their boards.

Doing away with the dual-class share structure is a smart step toward reforming an entrenched, all-white, all-male board at Red Rock Resorts.

Greater Transparency

Family office investments and share pledging by Red Rock’s controlling insiders raise questions about potential conflicts of interest.

Red Rock’s chairman and vice-chair, Frank and Lorenzo Fertitta, have dual roles at Fertitta Capital, their family office founded in 2017 that has overlapping business interests with Red Rock in gaming, sports, betting, leisure, wellness, and food and beverage.

In 2019, Fertitta Capital led a $17.5 million funding round for a sports betting media company, The Action Network. It remains unclear if Red Rock’s board vetted the deal and whether the family firm receives opportunities owed to shareholders and now competes with Red Rock.

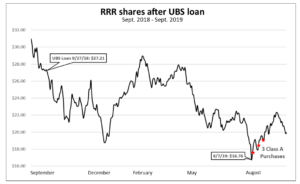

Also, Frank and Lorenzo Fertitta pledged six million or 13% of Class B shares in Red Rock in September 2018 for a margin loan worth up to an estimated $155 million from UBS AG, a bank that was a lender to Red Rock but stopped doing so. The loan pledges appear no longer to be in effect.

To date, Red Rock has not made any disclosures about Fertitta Capital, nor has it explained why UBS started lending to company insiders and stopped lending to the company.

Doing away with the dual-class share structure is a smart step toward transparency and fully protecting Red Rock from potential conflicts of interest.

(1) J.P. Morgan, “Red Rock Resorts: Takeaways from Investor Meetings. Story Still Has Legs. Reaffirm Overweight. PT to $48 (+$1),” North America Equity Research, p. 6 (May 14, 2021).