An Update on Private Jets (and Yachts!)

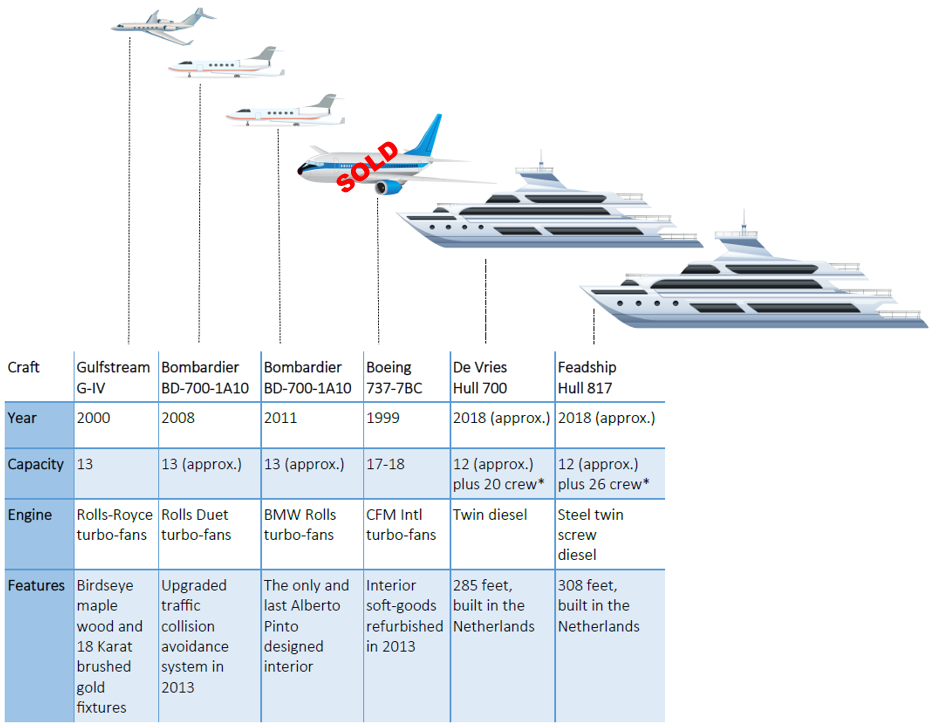

The Fertitta Fleet

Readers may recall that Fertitta Entertainment LLC, the Fertitta-owned company that had no business other than managing Fertitta-owned-Station Casinos’ properties under contract, was purchased by Fertitta-controlled Red Rock Resorts last year using IPO proceeds plus additional debt. One of the interesting features of the transaction was that the private jet of Fertitta Entertainment was not included in the deal. The $30-million airplane was instead “transferred” to Fertitta Business Management LLC, making the Fertittas collectively owners of four private jets.

No More Private Jets for Red Rock: Of the planes owned by Fertitta entities, a Boeing Business Jet and a Gulfstream G-IV have been on the market since at least February 9, 2017. The remaining jets not for sale are the 2011 Bombardier Global Express from Fertitta Entertainment and a 2008 Bombardier Global Express.

Even with their own private jets, sometimes the Fertittas would make use of the company jet for their own personal travel. In 2016, Red Rock’s CEO made $41,495 worth of personal use of the Fertitta Entertainment jet, up to the point of the consummation of the IPO, when the plane’s ownership transferred. In 2015 and 2014, the CEO compensation included $246,486 and $187,146 for “personal use of aircraft leased by Fertitta Entertainment,” respectively.[1] Before Station Casinos, Inc. filed for Chapter 11 bankruptcy, executives also made “personal use” of the company’s airplane. In 2006, for example, compensation for three executives included $147,765 of personal use of company aircraft.[2]

That’s a lot of personal travel on these executives’ part. But presumably the company (Red Rock and its pre-Chapter 11 predecessor Station Casinos Inc.) had a company jet for business purposes. Now that Red Rock Resorts is private jet-free, do its executives simply fly commercial as they try to look for growth opportunities outside Las Vegas, even around the world (e.g., Brazil)? Are they looking for growth opportunities?

The Fertittas’ private fleet made 153 flights into airports in southern California in the twelve months following RRR’s IPO. In the same period, international destinations included locations in southern Europe and the Caribbean (but no flights to Brazil).

From Private Jets to Mega-Yachts: While preparing to take their company public, the Fertittas financed the construction of two mega-yachts. Financing for a 285-foot yacht was secured on November 2, 2015, and for a 308-foot yacht on March 24, 2016. Photos of just one of the yachts have surfaced online.

Should billionaire owners of such super yachts continue to be subsidized by Red Rock Resorts outside shareholders, who have been paying the Fertittas’ income tax with cash “tax distributions”?

In 2016, cash distributions to owners of Station Casino LLC totaled $142.8 million, including $43.6 million of “tax distributions.” In 2015, cash distributions to owner of Station Casinos LLC totaled $162.3 million [3], but the amount of tax distributions was not disclosed.

* Based on capacity of yachts of similar length

[1] See Red Rock Resorts Inc., SEC Form 424B1, filed 4/28/16, p. 138; and Station Casinos LLC, SEC Form 10-K, filed 3/10/15, p. 112.

[2] Station Casinos Inc., SEC Form 10-K/A. filed 4/27/07, p. 16.

[3] Station Casinos LLC, SEC Form 10-K, filed 2/29/16, p. 81