Station Casinos has not entered any commercial gaming market outside of Nevada since it had to leave Missouri in 2000, while the gaming industry has expanded into many more new states since then. If investors seek a gaming company that can expand into multiple commercial markets outside of Las Vegas, be sure to ask Red Rock management what happened in Missouri. Station also aborted its online gaming venture within 2 years. But for tribal gaming, Station has been landlocked in Nevada.

All of these facts seem to warrant the classic warning for prospective investors: Do you want to put all your eggs in one gaming basket?

There has been little growth in overall gaming revenue in the Las Vegas locals gaming market since 2009. And Station Casinos has not noticeably gained market share.

Download our new report on growth questions about the Las Vegas locals market here.

Marc Falcone, Red Rock’s CFO, told the Nevada Gaming Control Board in January 2016 that

I do think we are encouraged by the backdrop of the economy. We do expect to experience additional growth. We think we are in the early stages of recovery, particularly in the locals business, and we are enthusiastic and excited about the backdrop, what we see economically and how that can translate into further growth across all revenue categories in our business today.

Yet economic data from federal agencies and gaming data from the Gaming Control Board suggest the current recovery in the Las Vegas area is moving slower than a previous post-recession recovery.

According to the National Bureau of Economic Research, there have been two recessions so far in the 21st century: one in 2001 and another that ended in June 2009. Four years after the first recession, Station Casinos opened its Red Rock Casino Resort & Spa. Four years after the second recession, Station Casinos’ founding family is cashing out $460 million through the Red Rock Resorts IPO.

Comparing Recoveries in Las Vegas Economy

| Post-Recession Growth |

Population ↑ |

Average Weekly Wages ↑ |

Number Employed ↑ |

| 2002 – 2006 |

22.3% |

19.2% |

24.5% |

| 2011 – 2015 |

9.4% (through Aug.) |

3.6% (through 3Q15) |

13.5% (through 3Q15) |

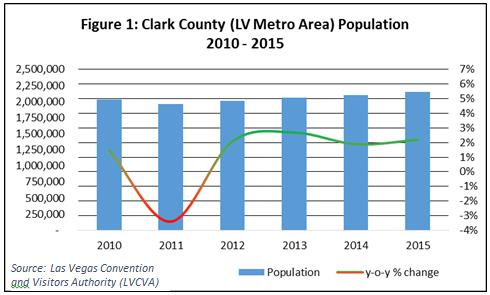

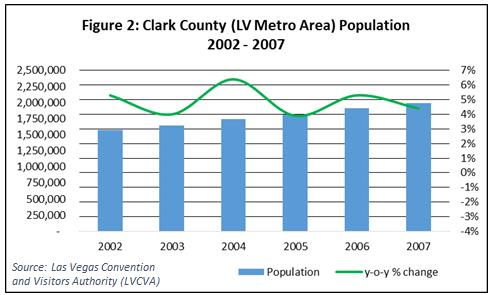

Recovery after the 2001 recession meant that, from 2002 to 2006, the population of the Las Vegas Valley grew by 22.3%, the average weekly wages of Clark County residents grew by 19.2%, and the total number of employed Clark County residents grew by 24.5%. During the current recovery, from 2011 to 2015, the population of the Las Vegas Valley grew by 9.4%, the average weekly wages of Clark County residents grew by 3.6%, and the total number of employed Clark County residents grew by 13.5%.

| Post-Recession CAGR |

Population ↑ |

Average Weekly Wages ↑ |

Number Employed ↑ |

| 2002 – 2006 |

5.2% |

4.6% |

5.6% |

| 2011 – 2015 |

2.3% (through Aug) |

0.3% (through 3Q15) |

3.2% (through 3Q15) |

Another way to compare these two sets of indicators would be to look at the growth rates. Following the 2001 recession the population grew at a compound annual rate of 5.2% and the number of people employed grew at a compound annual rate of 5.6%. In the four years after the more recent recession, not only did wages grow at a slower rate, but Las Vegas area population and the number of people employed grew at compound annual rate of 2.3% and 3.2%, respectively.

Recoveries and Tighter Slots in Las Vegas Locals Market

| Post-Recession Growth |

Slot Unit Count |

Slot Handle |

Slot Handle

Avg Monthly Growth |

| Dec. 2002 – Dec. 2006 |

↑18.7% |

↑36.2% |

$19.8 million |

| Dec. 2011 – Dec. 2015 |

↓11.5% |

↑ 1.1% |

$0.66 million |

In the Las Vegas locals gaming market, from December 2002 to December 2006, slot unit count grew by 18.7%, while slot handle climbed by 36.2% at an average of $19.8 million per month over the four-year period. In the current era, from December 2011 to December 2015, slot unit count declined by 11.5%, while slot handle climbed by 1.1% at an average of $660,000 per month.

Furthermore, we identify a potential limit to the current recovery in terms of the slot win percentage, i.e., how tight the slots are. From December 2011 to December 2015, total slot revenue amount grew 23.5%, while the slot unit count declined and slot handle was stagnant. This growth in market-wide gaming revenue was made possible because slots got tighter. Overall slot win rates (by the house) in the market went from 4.39% in December 2011 to 5.36% in December 2015, while slot win per unit per day rose 40%, from $75 per unit per day in December 2011 to $105 per unit per day in December 2015.

Growing casino revenue through tighter slots has its limits. The addition of more slot units, by comparison, indicates confidence in expanding demand. As noted in a previous report, when casino operators see their customers spend more on slots, they put more slots out on the floor. This was the case between 2004 and 2006 when slot wagers in the locals market rose by 20%, and owners added 7,343 slots to the market.

If the Las Vegas locals market has reached an inflection point and is about to take off, why is Red Rock selling its specially zoned casino development sites? You have no doubt read in the prospectus and heard from the company that Station Casinos has taken advantage of a Nevada law that restricts new neighborhood casinos from being developed and has bought up the only available future casino sites so that they “own and control” their own destiny. So why are they selling some of these sites now? Is it a reflection of what those economic numbers could be telling them about the future of their core business?