Questions about “Durango Station”

Back in 2007, Station Casinos received approvals from Clark County to build a 120,000-square-foot casino with 1,000 hotel rooms on its 71-acre property in southwest Las Vegas. The project had a $700 million budget and was to open in 2010 with a projected EBITDA of $110.1 million by 2012.[1] Then in 2008, the company reduced the size of the project, with new approvals for an 86,883-square-foot casino with 726 hotel rooms, plus 8 retail buildings totaling 139,071 square feet. The company received a fourth extension of time for this project in October, 2018, with a deadline to commence by September 3 this year.[2] On May 4, the company said it was looking to redesign the project to be “significantly tighter than anything that we’ve done in the past”, with “a focus on slot machines and table games, our primary business.”[3]

We believe investors should pose the following questions about the “Durango Station” project to management:

- Is there market demand for another Las Vegas Locals casino? While total slot handle in the Las Vegas Locals market reached a record of $41.1 billion in 2006, it had dropped to $35.1 billion in 2019. This happened in spite of the fact that Clark County’s population grew from 1.78 million in 2006 to 2.29 million in 2019.[4] Corresponding to this decline in local residents’ spending on slot machines, the number of slot machines in the market had been reduced from 52,947 at the end of 2006 to 44,696 at the end of 2019 and stood at 34,799 at the end of May, 2021. Station Casinos itself has yet to reopen four of its ten major properties after Nevada casinos were allowed to reopen more than a year ago (and is in fact selling one of them, the Palms). Will Durango Station be able to grow the Las Vegas Locals market given the long-term market-wide decline in slot handle?

- How many “Durango Station” customers will come from Red Rock Casino? Looking specifically at the area around the Durango site, we see that Station Casinos’ Red Rock Casino is 9 miles north. The 10-minute drive from the neighborhood around the Durango site to Red Rock is not a long distance to travel in Las Vegas. Given its player rewards program, the company likely has detailed data on where its regular Red Rock customers live. How many “Durango Station” customers then does management expect to be new customers instead of customer who will merely shift their business from Red Rock to the new property?

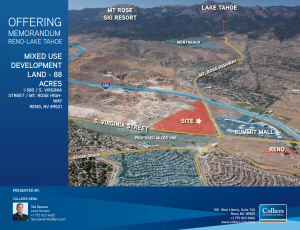

- How will “Durango Station” compete against nearby mixed-use developments? Again, looking at the Durango site, we see that, across the street from the Durango site, construction has already started on the $400-million UnCommons mixed-use project,[5] which is slated to open in early 2022,[6] at about the same time Station Casinos plans to start its own project.[7] UnCommons will have 20 vendors in a food hall, [8] including a celebrity chef’s new restaurant.[9] Less than a mile north of the Durango Station site, another mixed-use development called The Bend also broke ground in January, 2020, which will have 170,000 square feet of retail space, including a movie theater.[10] How will these large mixed-use projects nearby change the economics of the Durango Station project?

- What will happen to the Flamingo/I-215 site after “Durango Station”? One of Station Casinos’ future casino development sites in Las Vegas is the 58-acre Flamingo/I-215 parcel, which is located about halfway between Red Rock and the Durango site. After “Durango Station” opens, will the Flamingo site continue to be considered a future casino development site, or will the company seek to monetize some other way?

Check out our map of key properties and sites in the Las Vegas Locals market here.

Notes:

[1] See “Report of Investigation by the Special Litigation Committee of the Board of Directors of Station Casinos, Inc.”, filed as docket 353-3 in the Chapter 11 case of Station Casinos, Inc., case 09-52477-gwz in the U.S. Bankruptcy Court, District of Nevada. The merger proxy contains the project cost, and the attached Odyssey Capital Group’s Report to the Special Committee to the Board of Directors of Station Casinos, Inc., September 9, 2009 shows the projected EBITDA in “Valuation of short-term Development Assets” (by Bear Stearns Presentation to Station Casinos Special Committee on February 22, 2007).

[2] 10/17/2018 Clark County Zoning Commission meeting, agenda item #25, ET-18-400190 (UC-0726-08) by NP Durango, LLC. http://clark.granicus.com/MinutesViewer.php?view_id=17&clip_id=6025.

[3] Red Rock Resorts 1Q21 quarterly call on 5/4/2021, transcript by Seeking Alpha.

[4] Based on Nevada Gaming Control Board data.

[5] https://www.reviewjournal.com/business/developer-of-400m-las-vegas-complex-lands-new-tenant-2404247/

[6] https://www.naiop.org/Research-and-Publications/Magazine/2021/Summer-2021/Development-Ownership/New-Noteworthy

[7] Red Rock Resorts 1Q21 quarterly call on 5/4/2021, transcript by Seeking Alpha.

[8] https://www.reviewjournal.com/business/400m-development-project-taking-shape-in-southwest-las-vegas-2317761/

[9] https://www.reviewjournal.com/entertainment/food/celebrity-chef-michael-mina-to-head-off-strip-at-uncommons-2375335/

[10] https://www.reviewjournal.com/local/local-las-vegas/work-begins-on-the-bend-retail-complex-in-southwest-las-vegas-1947323/