Why did UBS start lending to Fertittas and stop lending to Red Rock? [updated 4.28.21]

Note: On 3/10/21, we published the following update: “Since publishing this article on February 8, 2021, we discovered the financing statement for the UBS loan to the Fertittas was terminated on March 23, 2020. Notwithstanding, the pledge and margin loan were still identified as in effect in Red Rock’s April 22, 2020 Form DEF 14A.” Now we can report that there is no pledge and margin loan identified as in effect in Red Rock’s April 22, 2021 Form DEF 14A. We have updated the report to reflect this new information. 4/28/2021.

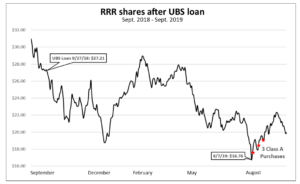

The controlling owners of Red Rock Resorts Inc. (NASDAQ: RRR), Frank Fertitta III and Lorenzo Fertitta, pledged six million or 13% of Class B Red Rock shares to UBS AG in September 2018 for a margin loan worth up to an estimated $155 million.

In February 2019, Red Rock disclosed the termination of a $50 million UBS commitment that had been identified as in effect in its Form 10-Q for the quarter ending September 30, 2017. In February 2020, it disclosed the termination of an $18.5 million commitment that had been identified as in effect in an amended credit agreement dated February 8, 2019.

On March 23, 2020, the financing statement for the UBS loan to the Fertittas was terminated. But the pledge and the margin loan were identified as in effect in Red Rock’s April 22, 2020 Form DEF 14A. No pledge and margin loan are identified as in effect in Red Rock’s April 22, 2021 Form DEF 14A.

Why did UBS end up by lending to the Fertittas personally but not to the public-traded company they controlled? And what caused the Fertittas to take on the margin loan in the first place? Why did UBS terminate the financing statement for the margin loan on March 23, 2020?

[See our letter to the SEC and Nasdaq requesting a closer look at pledged shares at Red Rock here.]

Red Rock has not explained what prompted the changed relationship with UBS. And why the Fertittas secured liquidity through a margin loan is also of potential interest to public shareholders given the Fertitta’s control of Red Rock.

On one hand there appears to be cash, lots of it. The Fertittas reportedly cleared $870 million each in the 2016 sale of the Ultimate Fighting Championship, and in August 2020 spent $74 million to purchase five million Red Rock shares (see here, here, here, here and here).

On the other hand, they have borrowed money—$64 million from a related party to buy Red Rock shares in August 2019—and, between one or the other of them, they have acquired a number of luxury assets: two superyachts, a support yacht, and a penthouse near Manhattan’s Central Park.

Two Fertitta yachts have been delivered since 2018, with a third delivered in 2021: the 285-foot Lonian ($160 million estimated); the 217-foot Hodor support yacht ($55 million estimated); and the 308-foot Viva ($175 million estimated).

Two helicopters share the initials of Frank and Lorenzo Fertitta and the Las Vegas area code (N702FF, N702LF) and are owned by entities that share the superyacht names (Viva Eagle LLC, Lonian Raven LLC).

Hodor Holdings Limited is named as a secured party in an August 2017 financing statement related to the construction of an “equipped submersible” by Seamagine Hydroscape Corporation. Hodor Holdings, Ltd.’s address is identified as the same Las Vegas address as Fertittas Enterprises, Inc.

UBS promotes its securities-backed loans as useful for purchasing yachts, among other things. But as it stands, Red Rock investors have no basis to know what the loan proceeds were used for.

Red Rock’s securities pledging policy, a summary of which was first disclosed in April 2020, does not appear to cap pledging even though it requires certain insiders to “pre-clear” transactions in company securities.

Moreover, it is not clear which persons would review and approve such “pre-clearances.” And Red Rock has not disclosed whether the 2018 margin loan transaction was subject to the current policy.

Investors are in the dark about the details of pledged shares at Red Rock. They deserve sufficient information to decide whether such pledges benefit the company.