Baron’s Sunk Cost Trap: Red Rock Resorts

Over the past year, Baron has been building a position in Red Rock Resorts, Inc. (NASDAQ: RRR) and is now the second largest outside investor, owning just over 10% of the publicly listed Class A shares of RRR. Red Rock’s shares have underperformed both the market and its peers, year-to-date. Baron’s efforts to double down on Red Rock’s stagnant stock suggest its stock pickers have fallen into a sunk cost trap, unwilling to recognize the opportunity cost they’ve incurred by putting millions more of their clients’ money in RRR over the past year.

Sunken Costs

Baron filed a 13G on October 10, 2017, announcing its 10.42% ownership of Red Rock Resorts, Inc.’s Class A shares outstanding.[i] Baron began developing its position in Red Rock following the latter’s IPO in April 2016. As early as June 30, 2016, Baron reported owning 3,605,258 (or approximately 8.7% at the time) of Red Rock’s Class A shares outstanding.[ii]

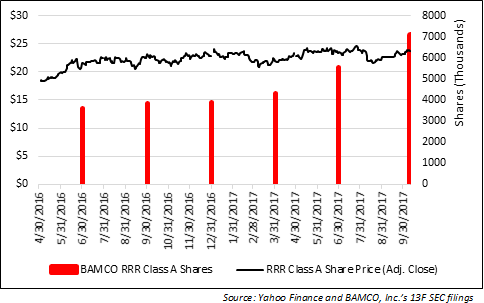

Baron’s stock pickers slowly increased the firm’s holdings in Red Rock through late 2016 and early 2017, with significant increases both in the 2Q17 (29% increase in number of shares since previous 13F) and in a 13G filed on October 10th, 2017 (28% increase) (Chart 1).[iii],[iv],[v] What value do Baron’s stock pickers see in a stagnant, underperforming security such as Red Rock?

Chart 1: RRR Share Price and Baron’s RRR Class A Ownership

Red Rock’s share price has underperformed the markets year-to-date. As of the closing prices on November 8, 2017, the NASDAQ composite index is up 24.0% and the S&P 500 is up 14.3%, while Red Rock’s share price has increased by 11.0%. On the other hand, Red Rock’s peers have significantly outperformed the markets year-to-date (Chart 2).

Chart 2: Share Price Performance of RRR and Industry Peers (YTD)

Opportunity Cost

What would it look like if instead of sinking more money into Red Rock, Baron’s portfolio managers had chosen to invest in one of its peers? Baron’s reported ownership of 3,900,959 of Red Rock’s Class A shares as of December 31, 2016.[vi] The value of this number of shares at the start of 2017 was approximately $91 million.[vii] Baron’s decision to stay invested in Red Rock came with a significant opportunity cost (Table 1). If Baron had bought shares in any of these other gaming companies instead of Red Rock Resorts, it would have seen a sizable YTD gain instead of a negligible return from RRR Class A shares.

Table 1: Market Appreciation and Opportunity Cost YTD (through 11/8/17)

| Company | Share Price YTD % change (through 11/8/17) |

Potential Value (as of 11/8/17) |

Opportunity Cost |

| Eldorado Resorts | 67.3% | $152 mm | $51 mm |

| Boyd Gaming | 42.4% | $130 mm | $29 mm |

| Golden Entertainment | 154.4% | $232 mm | $130 mm |

| Pinnacle Entertainment | 81.6% | $165 mm | $64 mm |

| Penn National | 91.1% | $173 mm | $73 mm |

What makes Baron’s position in RRR even more interesting is that the firm has nearly doubled (82% increase) its ownership of Red Rock’s Class A shares from the beginning of the year until its latest filing on October 10, 2017.[viii],[ix] Given the opportunity cost of its RRR investment, Baron’s stake will need to generate a much greater return than what can be expected from RRR’s current 12-month consensus price target of $28.50 for the firm’s position to make financial sense.[x] Whatever Baron’s internal price target for RRR might be, the firm must assume that RRR will greatly outpace its gaming peers over a reasonable investment period.

Baron’s fund managers should not be satisfied with seeing RRR reach $28.50 by the end of 2018, considering the much bigger returns it could have gotten if it had invested in one of its peers.

Notes

[i] BAMCO, Inc., SEC Form 13G, filed on October 10, 2017.

[ii] BAMCO, Inc., SEC Form 13F, Information Table, filed on August 14, 2016, as of June 30, 2016.

[iii] BAMCO, Inc., SEC Form 13F, Information Table, filed on May 15, 2017, as of March 31, 2017.

[iv] BAMCO, Inc., SEC Form 13F, Information Table, filed on August 14, 2017, as of June 30, 2017.

[v] BAMCO, Inc., SEC Form 13G, filed on October 10, 2017.

[vi] BAMCO, Inc., SEC Form 13F, Information Table, filed on February 14, 2017, as of December 31, 2016.

[vii] Red Rock’s opening share price on January 3, 2017 was $23.36.

Yahoo Finance, “Red Rock Resorts,” Historical Data, website, accessed on October 3, 2017. https://finance.yahoo.com/quote/RRR/history?p=RRR

[viii] BAMCO, Inc., SEC Form 13F, Information Table, filed on February 14, 2017, as of December 31, 2016.

[ix] BAMCO, Inc., SEC Form 13G, filed on October 10, 2017.

[x] Consensus Price Target as reported by NASDAQ’s website. Accessed on November 9, 2017. http://www.nasdaq.com/symbol/rrr/analyst-research