How Will Red Rock Grow in a Saturated and Stagnant Market?

In its IPO prospectus, Red Rock Resorts (NASDAQ: RRR) told investors two important pieces of information about its Las Vegas business:

- “Our Las Vegas properties are broadly distributed throughout the market and easily accessible, with over 90% of the Las Vegas population located within five miles of one of our gaming facilities.”

- “[W]e estimate that nearly half of the adult population of the Las Vegas metropolitan area are members of our Boarding Pass program and have visited one or more of our properties during the year ended December 31, 2015.”

(Check out our interactive map of “Station Casinos and the Las Vegas Regional Market“)

While these numbers may sound impressive, they also appear to leave little room for growth with respect to the company’s Las Vegas locals business. It is difficult to envision significant revenue bumps from building or acquiring more properties to cover the 10% of the population not currently living within a five-mile radius of an RRR property. In addition, if the company’s estimate is right a nd nearly half of the adult population in Las Vegas are members of its player rewards program, RRR will find difficulty signing up new locals since a recent survey tells us that only slightly over half of the adult population gambles (see section below on “Local gaming behaviors”).

The flip side of the company’s saturation of the locals market means growth in its core Las Vegas business would have to come from significant increases in (1) the population of Las Vegas and/or (2) customer spending per capita. In this report, we examine available data to assess the likelihood of either happening. Our conclusion: facing low population growth and a decline in locals’ gaming behaviors, RRR is unlikely to experience much, if any, upside in its core Las Vegas locals business, which accounted for 92% of its net revenues and 89% of its adjusted EBITDA in the first quarter of 2016.

Las Vegas population trends

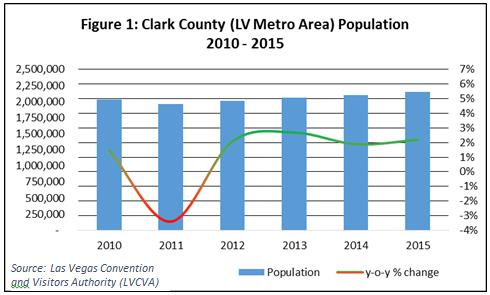

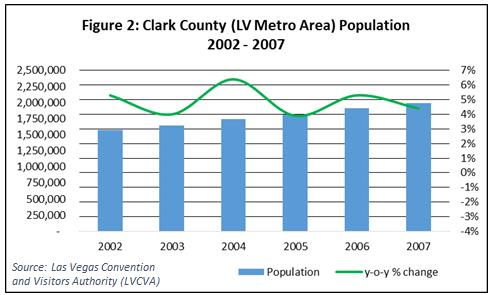

The Las Vegas metropolitan area has shown some growth in population over the past five years, in spite of a slight dip in 2011. However, what we are seeing now does not compare to the significant population growth Las Vegas experienced during the early to mid-2000s. Moreover, Las Vegas is unlikely to see the same kind of population boom like it did in the 2000s, according to expert projections.

From 2010 to 2015, the Las Vegas population grew 5.46% (Figure 1), compared to 26.5% population growth from 2002 to 2007 (Figure 2).

Annual population growth from 2010 to 2015 averaged 1.2% with a peak of 2.7% in 2013. From 2002 to 2007, annual growth averaged more than 4 times higher at 4.9% with a peak of 6.4% in 2004.

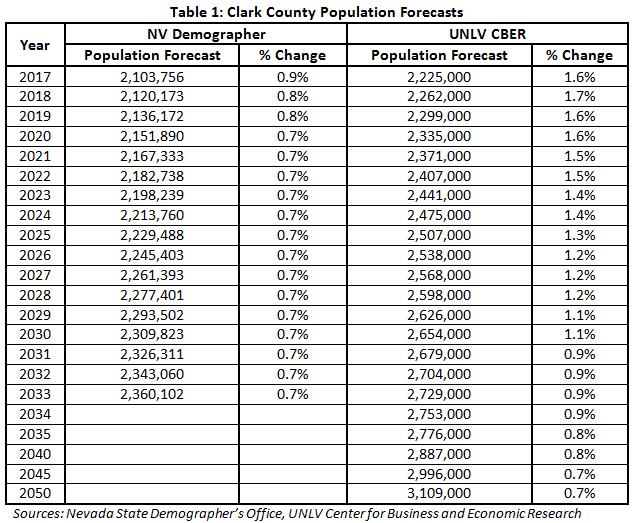

This kind of population explosion is not likely to return, according to projections by experts. Population forecasts show low, single-digit growth for the Las Vegas metropolitan area. The Nevada State Demographer’s Office predicts 0.9% annual growth rates or lower for 2017 through 2033 and UNLV’s Center for Business and Economic Research (CBER) estimates annual growth rates of 1.7% and lower from 2017 through 2050 (Table 1).

With little population growth ahead, the Las Vegas locals market looks like a mature market that is unlikely to expand significantly. As 90% of the existing population already lives within five miles of one of the RRR properties, growth in the company’s core Las Vegas business would need to come from more customer visits and greater customer spending, not population expansion.

Local gaming behaviors

A useful source of information to gauge the health and growth potential of the Las Vegas locals market is the Clark County Residents Study commissioned by the Las Vegas Convention and Visitors Authority (LVCVA). These biennial studies are conducted with a random sample of 1,200 local participants and provide useful insights into locals’ gaming behavior and their overall entertainment spending patterns.

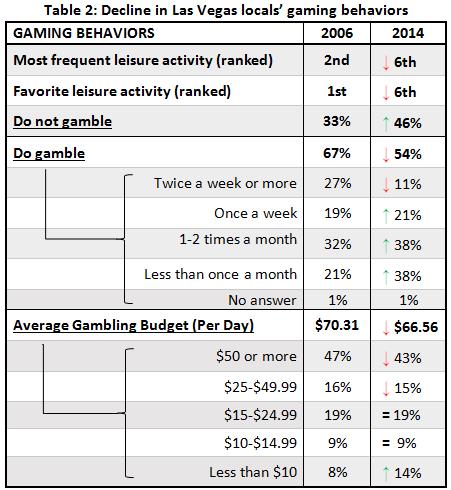

A comparison of the 2006 and 2014 Resident Study shows a significant decline in locals’ gaming activity, frequency, and budgets (Table 2).

As we noted earlier, almost half (46%) of Las Vegas residents did not gamble in 2014, a percentage that rose significantly from the one-third (33%) who said they did not gamble back in 2006. In addition, how locals rank gambling among both their most frequent and favorite leisure activities, how often people gamble, and how much they budget for gambling are down across the board. These declining gauges of locals’ gaming behavior are consistent with what we have observed in the stagnant slot handle for the Las Vegas locals market, which we described in a previous report.

Since locals are gambling less and population growth is slow going forward, it is unclear how Red Rock can grow its core Las Vegas business.